Nanomaterial Additive Manufacturing in 2025: Unleashing Next-Gen Performance and Market Expansion. Explore How Advanced Nanomaterials Are Transforming Additive Manufacturing and Driving Double-Digit Growth Through 2030.

- Executive Summary: Key Trends and Market Drivers in 2025

- Market Size, Segmentation, and 2025–2030 Growth Forecasts

- Breakthrough Nanomaterials: Types, Properties, and Applications

- Technology Landscape: 3D Printing Methods and Nanomaterial Integration

- Competitive Analysis: Leading Companies and Strategic Initiatives

- Emerging Use Cases: Aerospace, Medical, Electronics, and Beyond

- Supply Chain and Manufacturing Challenges

- Regulatory Environment and Industry Standards

- Investment, M&A, and Startup Ecosystem

- Future Outlook: Opportunities, Risks, and Innovation Roadmap

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

Nanomaterial additive manufacturing (AM) is poised for significant growth and transformation in 2025, driven by advances in material science, increased industrial adoption, and the maturation of production-scale technologies. The integration of nanomaterials—such as carbon nanotubes, graphene, and metal nanoparticles—into additive manufacturing processes is enabling the creation of components with enhanced mechanical, electrical, and thermal properties, opening new possibilities across sectors including aerospace, automotive, healthcare, and electronics.

A key trend in 2025 is the rapid commercialization of nanomaterial-infused filaments and powders for established AM platforms. Companies like BASF and Evonik Industries are expanding their portfolios of nanocomposite materials, targeting applications that demand lightweighting, conductivity, and superior strength-to-weight ratios. These materials are being adopted in the production of functional prototypes and end-use parts, particularly in aerospace and automotive, where performance and weight reduction are critical.

Another major driver is the increasing collaboration between AM hardware manufacturers and nanomaterial suppliers. For example, Stratasys and 3D Systems are working with material innovators to qualify and certify new nanomaterial-based feedstocks for their industrial printers. This is accelerating the transition from research-scale demonstrations to reliable, repeatable production, addressing key concerns around consistency and scalability.

In the healthcare sector, the use of nanomaterial AM is advancing rapidly, with companies such as Smith+Nephew exploring nanostructured implants and scaffolds for improved biocompatibility and osseointegration. The ability to tailor surface properties at the nanoscale is expected to drive further adoption in orthopedics and dental applications over the next few years.

Sustainability is also emerging as a significant market driver. Nanomaterial AM enables the production of lighter, more efficient components, reducing material waste and energy consumption. Companies like Airbus are investing in nanomaterial AM to support their decarbonization goals, leveraging the technology to produce next-generation aircraft parts with reduced environmental impact.

Looking ahead, the outlook for nanomaterial additive manufacturing in 2025 and beyond is robust. Ongoing investments in R&D, the standardization of materials and processes, and the expansion of application-specific solutions are expected to drive double-digit growth rates. As more industries recognize the value proposition of nanomaterial AM, the sector is set to become a cornerstone of advanced manufacturing strategies worldwide.

Market Size, Segmentation, and 2025–2030 Growth Forecasts

The nanomaterial additive manufacturing (AM) market is poised for significant expansion between 2025 and 2030, driven by rapid advancements in both nanomaterial synthesis and AM process technologies. As of 2025, the sector is characterized by a growing number of commercialized nanomaterial feedstocks—such as carbon nanotubes, graphene, metal nanoparticles, and ceramic nanocomposites—being integrated into established AM platforms. This integration is enabling the production of components with enhanced mechanical, electrical, and thermal properties, targeting high-value applications in aerospace, medical devices, electronics, and energy.

Market segmentation is primarily based on material type (metals, polymers, ceramics, and composites), AM technology (powder bed fusion, material extrusion, binder jetting, and directed energy deposition), and end-use industry. Metal nanomaterials, particularly those involving titanium, aluminum, and copper nanoparticles, are gaining traction in aerospace and automotive sectors due to their superior strength-to-weight ratios and functionalization potential. Companies such as GKN Powder Metallurgy and Höganäs AB are actively developing and supplying advanced metal powders tailored for AM, including those with nanoscale features.

In the polymer segment, nanocomposite filaments and resins—often incorporating carbon nanotubes or graphene—are being adopted for high-performance parts in electronics and healthcare. Stratasys and 3D Systems are among the leading AM system providers collaborating with material innovators to qualify and commercialize nanomaterial-infused polymers for their platforms. Meanwhile, ceramic nanomaterials are being explored for dental, biomedical, and high-temperature applications, with companies like XJet advancing nanoparticle jetting technologies for precise ceramic part fabrication.

From 2025 to 2030, the nanomaterial AM market is expected to experience a compound annual growth rate (CAGR) in the double digits, outpacing the broader AM sector. This growth is underpinned by increasing industrial adoption, ongoing qualification of nanomaterial-based parts for critical applications, and the scaling of production capacities. Strategic partnerships between AM hardware manufacturers, material suppliers, and end-users are accelerating the commercialization cycle. For example, EOS is working with nanomaterial developers to expand its portfolio of high-performance powders for industrial 3D printing.

Looking ahead, the market outlook remains robust, with anticipated breakthroughs in process control, in-situ monitoring, and post-processing techniques further unlocking the potential of nanomaterial AM. As regulatory frameworks and standardization efforts mature, particularly for medical and aerospace applications, the adoption curve is expected to steepen, positioning nanomaterial additive manufacturing as a transformative force in advanced manufacturing by 2030.

Breakthrough Nanomaterials: Types, Properties, and Applications

Nanomaterial additive manufacturing (AM) is rapidly advancing, with 2025 marking a pivotal year for the integration of nanoscale materials into 3D printing processes. The convergence of nanotechnology and AM is enabling the fabrication of components with unprecedented mechanical, electrical, and functional properties, opening new frontiers in aerospace, biomedical, electronics, and energy sectors.

Key nanomaterials currently being utilized in additive manufacturing include carbon nanotubes (CNTs), graphene, nanoceramics, metal nanoparticles, and nanocomposites. These materials are incorporated into polymer, metal, or ceramic matrices to enhance strength, conductivity, thermal stability, and other critical properties. For example, the addition of CNTs or graphene to polymer filaments has been shown to significantly improve tensile strength and electrical conductivity, making them attractive for lightweight structural and electronic applications.

In 2025, several industry leaders are scaling up the production and application of nanomaterial-infused AM products. BASF, through its Forward AM division, is actively developing and commercializing nanocomposite filaments and powders for industrial 3D printing, focusing on enhanced mechanical and thermal performance. Arkema is leveraging its expertise in advanced materials to supply nanostructured resins and powders, particularly for high-performance applications in automotive and aerospace. Evonik Industries is expanding its portfolio of nanomaterial-based AM materials, including polyamide powders with tailored nanoparticle additives for improved durability and processability.

Metal additive manufacturing is also benefiting from nanomaterial integration. GKN Powder Metallurgy is exploring the use of metal nanopowders and nanostructured alloys to achieve finer microstructures and superior mechanical properties in printed parts. Meanwhile, Oxford Instruments is providing advanced characterization tools to monitor and optimize the dispersion of nanomaterials within AM feedstocks, ensuring consistent quality and performance.

The outlook for nanomaterial additive manufacturing over the next few years is highly promising. Ongoing research is focused on overcoming challenges such as nanoparticle dispersion, interfacial bonding, and scalability of production. Industry collaborations and investments are accelerating, with companies like Sandvik and Henkel investing in R&D for next-generation nanomaterial AM solutions. Regulatory bodies and industry consortia are also working to establish standards for nanomaterial safety and performance in AM.

By 2027, it is expected that nanomaterial-enhanced AM will be routinely used for high-value, mission-critical components, particularly in sectors demanding lightweighting, multifunctionality, and miniaturization. The synergy between nanomaterials and additive manufacturing is set to redefine the boundaries of material science and industrial production.

Technology Landscape: 3D Printing Methods and Nanomaterial Integration

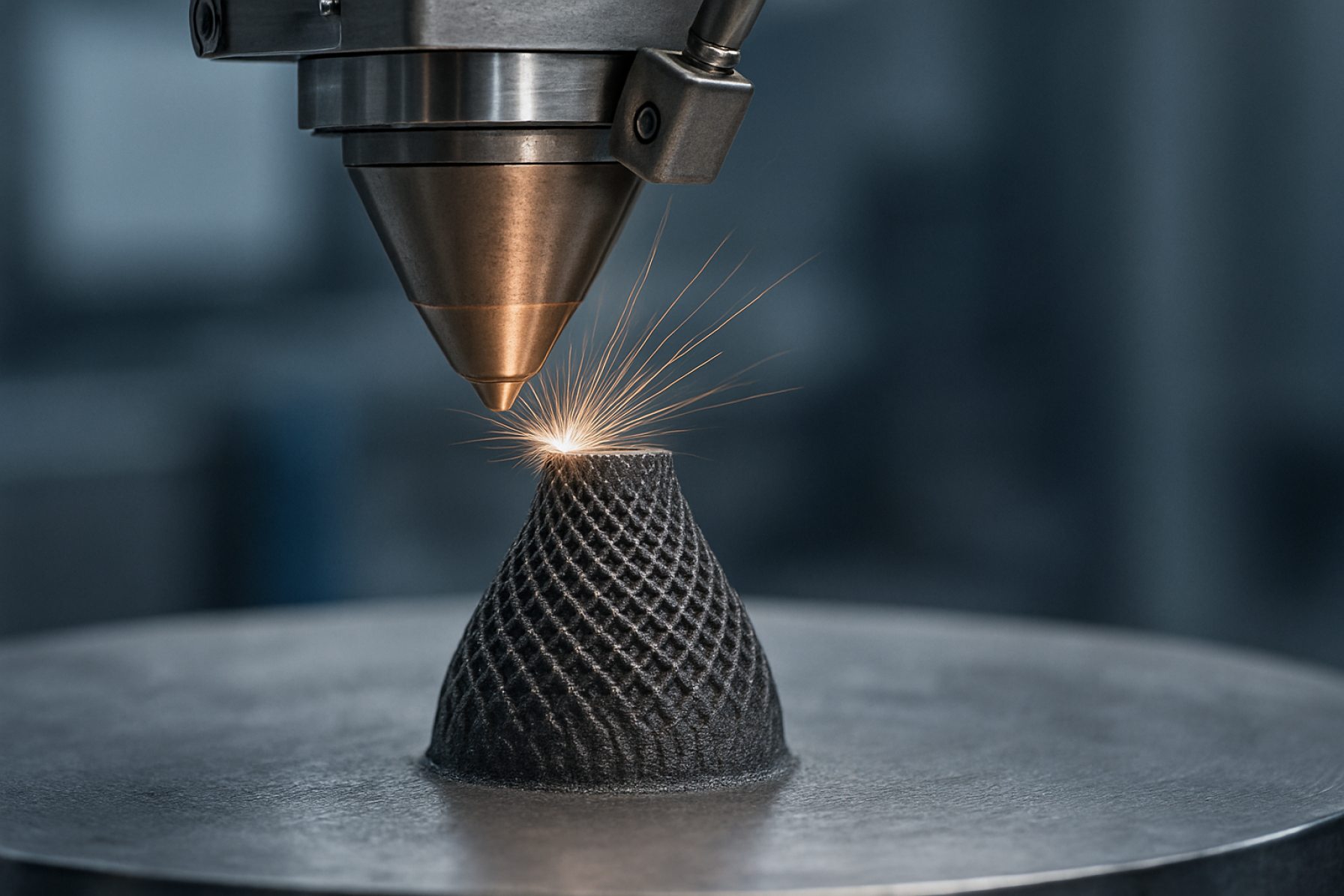

The technology landscape for nanomaterial additive manufacturing (AM) in 2025 is characterized by rapid advancements in both 3D printing methods and the integration of nanomaterials into printable matrices. The convergence of these technologies is enabling the production of components with unprecedented mechanical, electrical, and functional properties, driving innovation across sectors such as aerospace, healthcare, and electronics.

Among the primary 3D printing methods, material extrusion (notably fused filament fabrication, FFF), vat photopolymerization (such as stereolithography, SLA), and powder bed fusion (PBF) are the most actively explored for nanomaterial integration. Material extrusion has seen significant progress with the incorporation of carbon nanotubes, graphene, and metal oxide nanoparticles into thermoplastic filaments, enhancing conductivity and mechanical strength. Companies like Stratasys and 3D Systems are actively developing and commercializing composite filaments and resins that leverage nanomaterial additives for improved part performance.

Vat photopolymerization is also evolving, with the introduction of nanomaterial-infused resins that offer tailored optical, thermal, and electrical properties. For example, the integration of ceramic and metallic nanoparticles into photopolymers is enabling the production of high-resolution, functional microdevices. Nanoscribe, a leader in two-photon polymerization, is at the forefront of fabricating micro- and nanoscale structures with embedded nanomaterials, targeting applications in micro-optics and biomedical devices.

Powder bed fusion, particularly selective laser sintering (SLS) and selective laser melting (SLM), is being adapted for nanomaterial-laden powders. The addition of nanoscale reinforcements such as silicon carbide or boron nitride to metal and polymer powders is resulting in parts with superior wear resistance and thermal stability. EOS and Renishaw are notable for their ongoing research and product development in this area, focusing on the qualification of new nanocomposite powders for industrial AM systems.

Looking ahead, the next few years are expected to see further standardization of nanomaterial feedstocks, improved dispersion techniques, and the scaling of production processes. Industry collaborations and partnerships with nanomaterial suppliers are accelerating the qualification of new materials for certified end-use parts. The integration of real-time process monitoring and closed-loop control systems is also anticipated to enhance the reliability and repeatability of nanomaterial AM, paving the way for broader adoption in regulated industries.

Competitive Analysis: Leading Companies and Strategic Initiatives

The competitive landscape of nanomaterial additive manufacturing (AM) in 2025 is characterized by a dynamic interplay between established industry leaders, innovative startups, and strategic collaborations. The sector is witnessing rapid advancements in both material development and printing technologies, with companies focusing on scaling up production, enhancing material properties, and expanding application domains.

Among the frontrunners, BASF continues to leverage its expertise in advanced materials, offering a portfolio of nanomaterial-enhanced polymers and composites tailored for AM. BASF’s strategic investments in R&D and partnerships with 3D printer manufacturers have enabled the commercialization of high-performance filaments and resins, particularly for automotive and aerospace applications. Similarly, Arkema is expanding its nanomaterial-based resins, focusing on photopolymerization and powder bed fusion processes, and collaborating with printer OEMs to optimize material-printer compatibility.

In the metals segment, GKN Powder Metallurgy is at the forefront, integrating nanostructured metal powders into its additive manufacturing offerings. The company’s focus on process optimization and quality assurance is driving adoption in high-value sectors such as aerospace and medical devices. Oxford Instruments is also notable for its work in nanomaterial characterization and process monitoring, providing critical tools for quality control in AM production lines.

Startups and scale-ups are playing a pivotal role in pushing the boundaries of nanomaterial AM. Nanoe, for example, specializes in ceramic and metal nanomaterial feedstocks, enabling the production of parts with superior mechanical and thermal properties. Their Zetamix product line is gaining traction among research institutions and industrial users seeking advanced functional components. Meanwhile, XJet is commercializing nanoparticle jetting technology, which allows for the precise deposition of metal and ceramic nanoparticles, opening new possibilities for complex geometries and multi-material printing.

Strategic initiatives in 2025 are increasingly centered on ecosystem development and end-use application expansion. Companies are forming alliances with end-users in sectors such as energy, healthcare, and electronics to co-develop tailored solutions. For instance, collaborations between material suppliers and medical device manufacturers are accelerating the adoption of nanomaterial AM for implants and surgical tools with enhanced biocompatibility and functionality.

Looking ahead, the competitive environment is expected to intensify as more players enter the market and existing companies scale up production capacities. The focus will likely shift toward standardization, regulatory compliance, and the development of digital platforms for material qualification and process monitoring. As nanomaterial AM matures, companies that can offer integrated solutions—combining advanced materials, printing technologies, and application expertise—will be best positioned to capture emerging opportunities.

Emerging Use Cases: Aerospace, Medical, Electronics, and Beyond

Nanomaterial additive manufacturing (AM) is rapidly advancing from laboratory research to real-world applications, with 2025 marking a pivotal year for its integration into high-value sectors. The unique properties of nanomaterials—such as enhanced mechanical strength, electrical conductivity, and tailored surface functionalities—are enabling breakthroughs across aerospace, medical, electronics, and other industries.

In aerospace, the demand for lightweight, high-performance components is driving the adoption of nanomaterial-infused AM. Companies like Boeing and Airbus are exploring the use of carbon nanotube (CNT) and graphene-reinforced polymers for 3D-printed structural parts, aiming to reduce weight while maintaining or improving strength and durability. These materials are also being evaluated for their potential to enhance thermal and electrical conductivity in critical components, such as satellite housings and antenna structures. The integration of nanomaterials into AM processes is expected to accelerate as qualification standards mature and supply chains stabilize.

In the medical sector, nanomaterial AM is enabling the fabrication of patient-specific implants and devices with improved biocompatibility and functionality. For example, Stratasys and 3D Systems are developing AM platforms capable of processing nanocomposite biomaterials, such as silver nanoparticle-infused polymers for antimicrobial implants and titanium-based nanostructures for enhanced osseointegration in orthopedic devices. The ability to precisely control surface topography at the nanoscale is opening new possibilities for tissue engineering scaffolds and drug delivery systems, with regulatory pathways for such products becoming clearer as clinical data accumulates.

Electronics manufacturing is another area witnessing rapid adoption of nanomaterial AM. Companies like Nano Dimension are commercializing additive processes for printing circuit boards and electronic components using conductive inks containing silver nanoparticles, graphene, and other advanced nanomaterials. This approach enables the production of highly miniaturized, flexible, and customized electronic devices, supporting trends in wearable technology, IoT, and advanced sensors. The ability to print multi-material, multi-layered structures in a single process is expected to disrupt traditional electronics manufacturing workflows.

Beyond these sectors, nanomaterial AM is being explored for energy storage devices, filtration membranes, and even in the automotive industry for lightweight, high-strength parts. As material suppliers such as BASF and Arkema expand their portfolios of printable nanocomposites, and as AM hardware providers integrate advanced process controls, the next few years are likely to see a surge in commercial-scale applications. The outlook for 2025 and beyond is characterized by increasing cross-industry collaboration, standardization efforts, and a growing ecosystem of qualified materials and processes, positioning nanomaterial additive manufacturing as a transformative force in advanced manufacturing.

Supply Chain and Manufacturing Challenges

The supply chain and manufacturing landscape for nanomaterial additive manufacturing (AM) in 2025 is marked by both rapid innovation and persistent challenges. As the integration of nanomaterials—such as carbon nanotubes, graphene, and metal nanoparticles—into AM processes accelerates, manufacturers are encountering unique hurdles related to material sourcing, process standardization, and scalability.

A primary challenge is the reliable and consistent supply of high-quality nanomaterials. Leading producers like Arkema and BASF have expanded their nanomaterial portfolios, but the global supply chain remains sensitive to fluctuations in raw material availability and geopolitical factors. For example, the production of graphene and carbon nanotubes is still concentrated in a handful of regions, making the supply chain vulnerable to disruptions. Additionally, the purity and batch-to-batch consistency of nanomaterials are critical for AM applications, yet achieving these standards at scale remains a technical and logistical challenge.

Another significant issue is the integration of nanomaterials into printable feedstocks. Companies such as 3D Systems and Stratasys are actively developing composite filaments and resins that incorporate nanomaterials, but ensuring uniform dispersion and preventing agglomeration during processing is complex. This affects not only the mechanical properties of the final printed parts but also the reliability and repeatability of the manufacturing process.

Process standardization and certification are also lagging behind material innovation. Industry bodies like ASTM International are working to establish standards for nanomaterial AM, but the rapid pace of material development often outstrips the ability to codify best practices. This creates uncertainty for manufacturers seeking to scale up production for critical sectors such as aerospace, automotive, and medical devices, where regulatory compliance is stringent.

Looking ahead, the outlook for nanomaterial AM supply chains is cautiously optimistic. Major chemical and materials companies are investing in new production facilities and partnerships to localize supply and improve resilience. For instance, Evonik Industries has announced expansions in specialty polymer and nanoparticle production to support additive manufacturing markets. Meanwhile, digital supply chain solutions and advanced quality control technologies are being adopted to enhance traceability and consistency.

In summary, while nanomaterial additive manufacturing is poised for significant growth, overcoming supply chain and manufacturing challenges will require coordinated efforts across material producers, AM technology developers, and standards organizations. The next few years will be pivotal in establishing robust, scalable, and reliable supply chains that can support the widespread adoption of nanomaterial-enabled AM.

Regulatory Environment and Industry Standards

The regulatory environment and industry standards for nanomaterial additive manufacturing (AM) are rapidly evolving as the sector matures and adoption accelerates in 2025. The integration of nanomaterials—such as carbon nanotubes, graphene, and metal nanoparticles—into AM processes introduces unique challenges related to safety, quality assurance, and environmental impact. Regulatory bodies and industry consortia are responding with new frameworks and guidelines to address these complexities.

In the United States, the U.S. Food and Drug Administration (FDA) continues to refine its approach to medical devices and implants produced via AM with nanomaterials, emphasizing biocompatibility, sterility, and traceability. The FDA’s Center for Devices and Radiological Health has issued guidance on technical considerations for AM, and is expected to update these documents to specifically address nanomaterial risks, such as nanoparticle release and long-term stability, by 2026. The U.S. Environmental Protection Agency (EPA) is also monitoring the environmental implications of nanomaterial use in AM, particularly regarding waste management and potential nanoparticle emissions during production and post-processing.

In Europe, the European Medicines Agency (EMA) and the European Chemicals Agency (ECHA) are collaborating to harmonize standards for nanomaterial-containing products, including those manufactured additively. The European Union’s REACH regulation is being updated to include more explicit requirements for nanomaterial registration, safety data, and labeling, with full implementation expected by 2027. The International Organization for Standardization (ISO) and the ASTM International are actively developing and revising standards specific to nanomaterial AM, such as ISO/ASTM 52900 and related documents, to ensure consistent terminology, testing protocols, and quality benchmarks.

Industry leaders are also shaping the regulatory landscape. Companies like 3D Systems and Stratasys are participating in standards committees and pilot programs to validate safe handling and processing of nanomaterial-infused powders and filaments. GE, through its additive division, is collaborating with regulatory agencies to establish best practices for aerospace and medical applications, focusing on in-situ monitoring and post-build validation of nanomaterial-enhanced components.

Looking ahead, the regulatory environment for nanomaterial AM is expected to become more stringent and harmonized globally. Stakeholders anticipate increased requirements for lifecycle assessments, worker safety protocols, and end-user transparency. As the technology matures, proactive engagement between manufacturers, regulators, and standards bodies will be critical to ensure both innovation and public trust in nanomaterial additive manufacturing.

Investment, M&A, and Startup Ecosystem

The nanomaterial additive manufacturing (AM) sector is experiencing a surge in investment and strategic activity as the technology matures and its commercial potential becomes increasingly evident. In 2025, venture capital and corporate investors are targeting startups and scale-ups that can bridge the gap between laboratory-scale innovation and industrial-scale production, particularly in sectors such as aerospace, medical devices, and energy storage.

A notable trend is the influx of funding into companies developing advanced nanomaterial feedstocks—such as carbon nanotubes, graphene, and metal nanoparticles—for use in 3D printing. Oxford Instruments, a leader in materials characterization and nanotechnology, has expanded its partnerships with additive manufacturing firms to accelerate the adoption of nanomaterial-enabled AM processes. Similarly, Arkema, a global specialty chemicals company, continues to invest in startups focused on nanocomposite resins and powders, aiming to enhance the mechanical and functional properties of printed parts.

Mergers and acquisitions are also shaping the competitive landscape. In late 2024 and early 2025, BASF—through its 3D Printing Solutions division—acquired minority stakes in several nanomaterial AM startups, seeking to integrate advanced nanomaterials into its existing portfolio of AM materials. This move is part of BASF’s broader strategy to lead in high-performance additive manufacturing materials, especially those leveraging nanoscale enhancements for improved strength, conductivity, and thermal management.

The startup ecosystem is vibrant, with new entrants focusing on scalable production of nanomaterial-infused filaments, powders, and resins. Companies such as 3D Systems and Stratasys are actively collaborating with nanomaterial suppliers to co-develop next-generation AM platforms capable of processing these advanced materials. These partnerships are often supported by joint investment funds and accelerator programs, reflecting a recognition that ecosystem collaboration is essential for overcoming technical and regulatory hurdles.

Looking ahead, the outlook for investment and M&A in nanomaterial additive manufacturing remains robust. Industry analysts anticipate continued consolidation as established AM players seek to secure access to proprietary nanomaterial technologies and as startups with proven scalability become attractive acquisition targets. The sector is also expected to benefit from increased public and private funding for advanced manufacturing and materials innovation, particularly in the US, Europe, and Asia-Pacific. As nanomaterial AM moves from pilot projects to mainstream adoption, the next few years will likely see a wave of strategic deals and capital inflows, further accelerating the commercialization of this transformative technology.

Future Outlook: Opportunities, Risks, and Innovation Roadmap

The future outlook for nanomaterial additive manufacturing (AM) in 2025 and the coming years is marked by rapid innovation, expanding commercial opportunities, and a set of technical and regulatory challenges. As the integration of nanomaterials—such as carbon nanotubes, graphene, and metal nanoparticles—into AM processes matures, the sector is poised for significant growth across industries including aerospace, healthcare, energy, and electronics.

Key industry players are accelerating the commercialization of nanomaterial-enabled AM. Stratasys and 3D Systems are actively developing platforms capable of processing nanocomposite materials, targeting applications that demand enhanced mechanical, electrical, or thermal properties. HP Inc. is also investing in multi-material and nano-scale printing capabilities, aiming to address the needs of electronics and medical device manufacturers. Meanwhile, Oxford Instruments is advancing nanomaterial synthesis and characterization tools, which are critical for quality assurance in AM workflows.

Opportunities in the near term include the production of lightweight, high-strength aerospace components, custom biomedical implants with improved biocompatibility, and next-generation energy storage devices. For example, the use of graphene-enhanced polymers in AM is expected to deliver parts with superior conductivity and durability, opening new markets for functional electronics and sensors. The automotive sector is also exploring nanomaterial AM for prototyping and end-use parts, with a focus on reducing weight and improving fuel efficiency.

However, several risks and challenges remain. The safe handling and environmental impact of nanomaterials are under scrutiny, with regulatory frameworks still evolving. Ensuring consistent dispersion of nanoparticles within printable matrices and achieving repeatable part quality are ongoing technical hurdles. Industry groups such as ASTM International are working to establish standards for nanomaterial AM, which will be crucial for broader adoption and certification in safety-critical sectors.

The innovation roadmap for 2025–2028 is expected to focus on scalable production methods, in-situ process monitoring, and the development of digital twins for nanomaterial AM. Collaborative R&D initiatives between manufacturers, material suppliers, and research institutions are anticipated to accelerate breakthroughs in printable nanomaterial formulations and hybrid manufacturing systems. As these advances converge, nanomaterial additive manufacturing is set to become a cornerstone technology for high-value, next-generation products.

Sources & References

- BASF

- Evonik Industries

- Stratasys

- 3D Systems

- Smith+Nephew

- Airbus

- XJet

- EOS

- Arkema

- Oxford Instruments

- Sandvik

- Henkel

- Nanoscribe

- Renishaw

- Nanoe

- Boeing

- Nano Dimension

- ASTM International

- European Medicines Agency

- European Chemicals Agency

- International Organization for Standardization

- GE